Toward the end of a previous post, I briefly mentioned the concept of the minimum viable developer and first projects. I want to focus and expand on that concept for any who are looking to get started as a real estate developer.

Every developer or investor I have heard or read about started as some other profession first. It’s common to hear that investors were handymen fixing up houses or engineers looking for better investment options.

It’s common for developers to have been brokers, architects, lawyers, builders, or investors. What separates the builder from the developer is that the builder handles the construction and the developer handles the finance. Either can do the other function too so there aren’t strict boundaries between them.

The point about getting started is that being a developer is almost never the first profession. And most developers get started part-time.

Another big consideration is your motivation for becoming a developer. Developing is often thankless work and pays less than other careers. If you are doing it for the money, this is probably the wrong profession since there are lots of easier, more lucrative options out there.

That said, developing is an essential component of community development. If you’re doing it because you want to be compensated for helping to make better places then you’re on the right track.

Source: Wikimedia Commons

Two Questions for Developers

The two questions developers face are what to build and where to build. You either have a product (i.e. building type) looking for a location or you have a location and want to figure out what should be built there.

Unless you already control a parcel of land, then you are likely looking to answer both questions.

As a beginner, you need a project you can get financed. If you build a tiny house or ADU, you may be able to pay for it out of pocket. I designed and built a tiny house myself for about $4,000. It was low quality and I sold it because I had gotten married and the kitchen wasn’t going to be adequate.

Some new developers can start bigger than that. Here are a few ways to finance that first project:

- Put 20% down and personally guarantee a conventional construction loan.

- Put 15% down, pay more fees, and use a hard money loan without a guarantee.

- Find an equity partner who can front the money and guarantee the loan.

- Find a veteran who can guarantee a 0% down VA construction loan.

Most new developers are not going to have the track record to find an equity partner or line up a qualified buyer to guarantee the loan. Most will need to save some money and/or use the development as a personal residence. Other sources of funding could be the sale of a home or a home equity line of credit (HELOC) which would have required you to have been a homeowner for some amount of time before.

What to Build

Once there are funds available, you have to pick a project. The simplest would be a fix and flip. Find a house that needs some repairs that you can adequately estimate and complete yourself or contract it out. Hard money lenders do those all the time.

For most investors, these kinds of deals aren’t very place-dependent. As long as the house will sell and you can make the numbers work, it’s good to go.

As a developer, you care about placemaking and community development. You’re looking at the entire neighborhood an how your efforts fit into that.

The next simplest project that starts to affect place would be to fix and hold. Either you find a renter for it or you live in it yourself to cover financing, get the homestead tax exemption, and capital gains exemption if you stay there 2 years. Bonus points if you convert a single-family house into a duplex formally or in stealth mode (aka a mother-in-law layout) or add an ADU to it.

The fourplex deserves some special attention here. It has the potential to transform most neighborhoods in this current US economy because 1) it is still considered single-family housing and qualifies for single-family financing, and 2) it diversifies vacancy risk for an investor who can only purchase one property. As a first new-construction project, most developers should be considering the fourplex as one of their go-to projects.

Where to Build

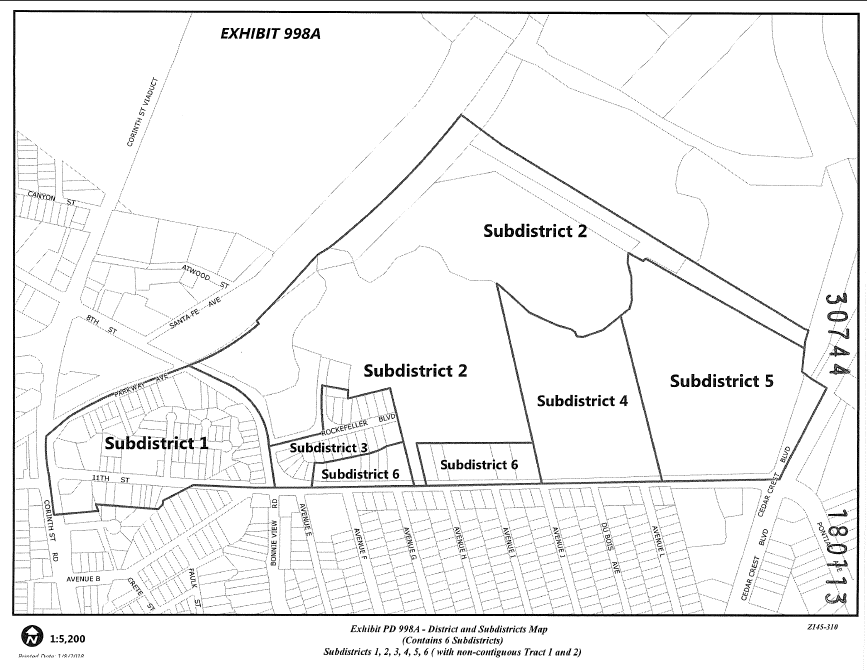

The second question is an education in itself. Many developers and those associated with the Incremental Development Alliance recommend “farming” where you live. If you happened to have moved to a location that has inventory in your price range and a zoning pattern (and city council) that is favorable to fourplexes, then congratulations, that might work for you.

In an earlier article, I introduced the concept of dynamic concentration in which I explained that we can’t fix everything all at once. We need to focus on one area and get it up to some minimum threshold. In working with commercial brokers and multifamily investors, I found that market forces are a more important consideration than investing in where you happen to live. Invest where you live if you can but don’t feel constrained to that.

I’ve also written before about city-wide site selection in the article about minimum viable urbanism and how and where to improve walkability. Additionally, it might make sense to map out your city’s value per acre so you can see the overall development pattern.

If we’re free to find a market then we look at many factors such as current inventory, job growth, development-friendly jurisdictions, and zoning. It’s much easier to find a zoning pattern friendly to fourplexes than it is to try to force one through a city planning process. Some cities have passed ordinances allowing ADUs on any residential parcel where they can fit. If you’re building ADUs, find those.

Once you’ve adequately answered the what and where questions you need to start feasibility studies. For a first deal, you don’t necessarily need a full proforma. That would be more for finding equity partners. Basically, you need to do back-of-the-napkin calculations to figure out whether you can afford to build the fourplex where you want. Will you make a profit when you sell it? Will the rent cover the mortgage and expenses?

If so, get a builder or architect lined up and apply for financing. One lender I spoke with said they would want a parcel under contract and construction documents to close a construction loan. While easier said than done, that process and what follows is well documented by the DIY literature. Find a book or a show on building your own home. Most of the same principles will apply.

There is so much more to say about both of these questions. I will continue elaborating in future articles as well as in an upcoming course. Subscribe to our newsletter for release details.

Leave a Reply